Table of Content

ValuePenguin tabulated the rate increases in the U.S. homeowners insurance marketplace using the RateWatch tool from S&P. We calculated average rate changes across the country according to each state's 10 largest insurance providers. In Florida, we tracked rates from every provider available in S&P's database. However, home insurance is far from a one-size-fits-all product. We recommend each of the providers in this review based on their advantages for Floridians.

Security First focuses on home insurance, offering several types of products including premier home insurance and flex home insurance. They also offer renters insurance, condo insurance, optional flood coverage, and more. Founded in 2005, Security First Insurance has just over 15 years' worth of experience in the insurance industry. The carrier is headquartered in Ormond Beach, FL. The insurance company is a leading provider of home insurance in the state of Florida. Security First offers all industry-standard basic coverages, in addition to several endorsements. For instance, let's say you select a policy covering the structure of your home up to $500,000 with a 2% hurricane deductible.

Security First Home Insurance Coverage

Before you purchase a policy, take a few minutes to compare coverage, discounts, and costs. We recommend obtaining quotes from at least three providers to ensure you get the right coverage and company for your needs. Similar to State Farm and Allstate, Liberty Mutual offers six standard areas of coverage—dwelling, other structures, liability, medical payments to others, loss of use, and personal property. State Farm is a trusted provider in the industry with 18% of market share. The largest home insurance provider in the country, State Farm also has a massive network of agents across Florida.

The This Old House Reviews Team has done some of the work for you, creating this in-depth Security First home insurance review to help you decide if the company is the best fit for your home. Security First Insurance is one of the worst insurance companies out there. Within two years they doubled the rate on my small home with no explanation, no claim, and excellent pay history. They started using the excuse of credit rating to start hiking up the rates. I have an 810 with no credit card debt and a small amount left on my mortgage.

Security First home insurance discounts

The condominium plan also includes personal liability and loss of use coverage, same as the HO-3 plan. An independent insurance agent can help you decide if Security First's home insurance is the right coverage for you. Security First is not currently rated by AM Best, the leading global credit organization monitoring the insurance industry. However, the company is rated an "A+" or "excellent" by the Better Business Bureau and is accredited through the organization. We've looked at over 1,000 insurance companies rating them on strength, accessibility, and service to find the best ones. Here's what people think about Security First Insurance Company.

An Excess & Surplus policy includes coverage for damage to the structure—your home—in the event of a covered loss. Editorial and user-generated content on this page is not reviewed or otherwise endorsed by any financial institution. In addition, it is not the financial institution’s responsibility to ensure all posts and questions are answered. Security First Insurance Company, a leading provider of homeowners insurance in Florida, is based in Ormond Beach, Florida.

Security First Insurance Customer Service

Information is displayed first and foremost for the benefit of consumers. The WalletHub rating is comprised of reviews from both WalletHub users and ratings on other reputable websites. This is more than three times higher than the average rate change that the rest of the country experienced during this time period (10.9%). If your deductible is $1,000, you will pay that amount when repairs are made, even if the repairs cost more.

For context, the cost of coverage rose by an average of 10.9% across the country during the same time. Because the Sunshine State and its coastal cities are particularly susceptible to hurricanes, Florida homeowners insurance rates are some of the highest in the country. In fact, more than 100 hurricanes have made landfall in Florida in the last 170 years, more than any other state. Hurricanes often come with storm surges, windstorm damage, lightning and extreme rainfall, leading to costly claims.

Find the Best Homeowners Insurance

It also offers unique online resources such as the common and costly claims tool, which flags the leading causes of claims in your area. To help you find the right amount of home insurance coverage at an affordable price, the This Old House Reviews Team created this guide. Keep reading our review to learn how to get the best homeowners insurance in Florida. Read this guide to learn which companies offer the best homeowners insurance policies in the Sunshine State.

And greed it is, in a state where many insurers are quitting the market. And, what is Florida Office of Insurance Regulation, Insurance Commissioner David Altmaier doing about it? The state of Florida does not require you to carry homeowners insurance, but your mortgage lender likely does. If you live in a high-risk flood zone, you may also be required to carry a flood insurance policy.

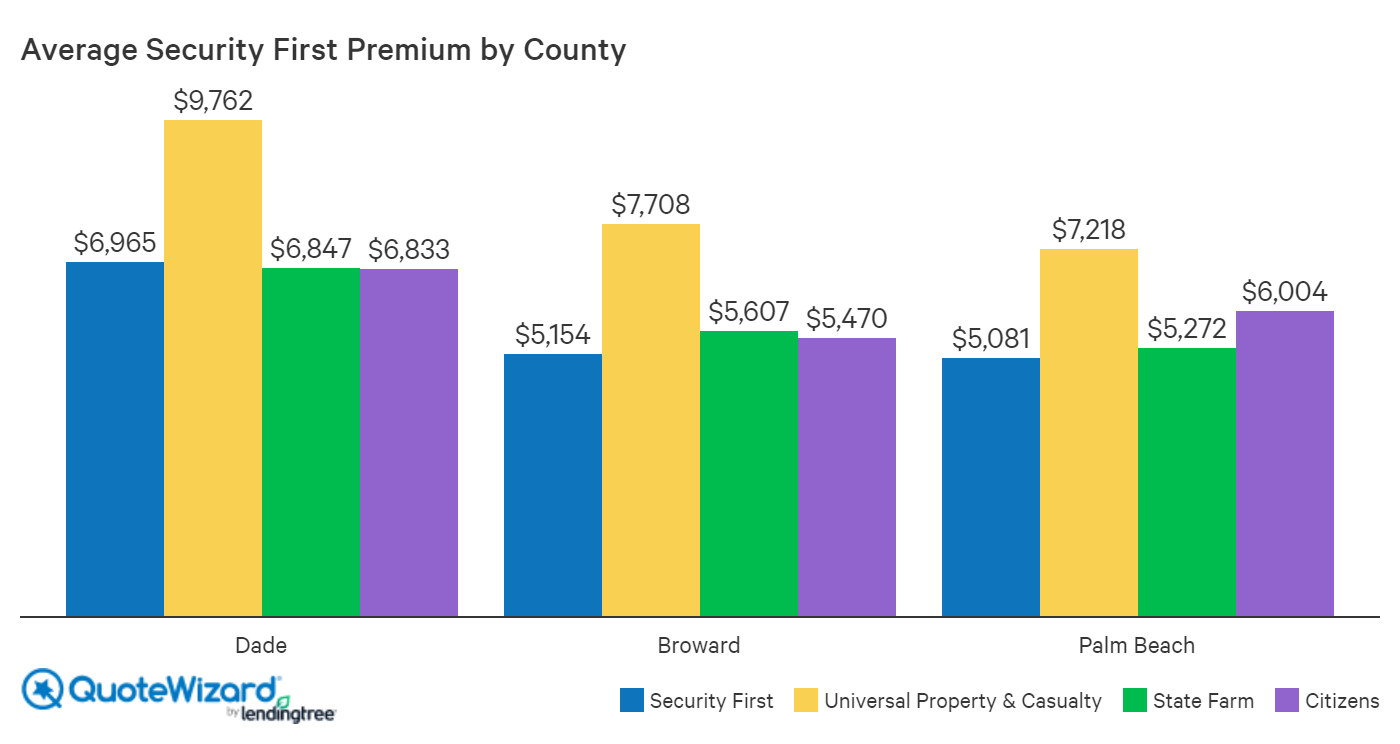

This is due to the company repetitively issuing lower settlement claims than the estimated repair cost, and many times clients are dropped off from their premiums for vague reasons. Security First is open and publically displays their premium rates – clients can receive immediate estimates based on the location of their home, the estimated value, and the shape. Their prices are displayed publically as opposed to many insurance companies who require clients to call agents before they can get an estimate. Security First’s rates are considered “average” for the Floridian market – they are not lower than the market average, nor are they higher than the average. Clients can expect average rates if their home meets the minimum value requirement.

If a hurricane strikes, you will have to pay $10,000 out of pocket before Security First begins covering the damage. And certain unattached structures, such as fences and sheds, may be excluded from coverage in the event of a hurricane. However, remember that insurance rates will differ for every home based on storm risk, your own claim history and other factors, so the only way to find your best price is to get a quote yourself. For example, Security First offered our sample homeowner a policy including $214,000 of dwelling coverage for just $455 per year.

No comments:

Post a Comment